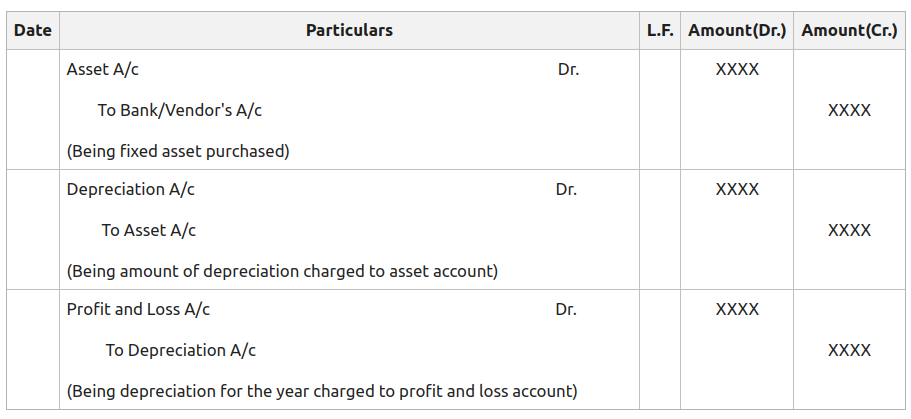

An example of how to calculate depreciation expense under the straight-line method — assume a purchased truck is valued at USD 10,000, has a residual value of USD 5,000, and a useful life of 5 years. The journal entry for this transaction is a debit to Depreciation Expense for USD 1,000 and a credit to Accumulated Depreciation for USD 1,000. On the balance sheet, a company uses cash to pay for an asset, which initially results in asset transfer. Accumulated depreciation is recorded as well, allowing investors to see how much of the fixed asset has been depreciated.

What Are Depreciation Expenses?

A typical presentation of accumulated depreciation appears in the following exhibit, which shows the fixed assets section of a balance sheet. For example, let’s say an asset has been used for 5 years and has an accumulated depreciation of $100,000 in total. Companies can depreciate their assets for accounting and tax purposes, and they have a number of different methods to choose from. Whichever way they decide to calculate it, depreciation expense will represent the amount for a single period and accumulated depreciation is the sum of depreciation expenses recorded for the asset up to that point. So, depreciation expense would decline to $5,600 in the second year (14/120) x ($50,000 – $2,000). Put another way, accumulated depreciation is the total amount of an asset’s cost that has been allocated as depreciation expense since the asset was put into use.

Why does accumulated depreciation have a credit balance on the balance sheet?

It represents a negative balance, offsetting the gross amount of fixed assets reported. Accumulated depreciation indicates the total wear and tear an asset has experienced throughout its useful life. The straight-line method of depreciation will result in depreciation of $1,000 per month ($120,000 divided by 120 months). Accumulated depreciation is the cumulative depreciation of an asset that has been recorded.Fixed assets like property, plant, and equipment are long-term assets. Accumulated depreciation is recorded in a contra account as a credit, reducing the value of fixed assets. Accumulated depreciation is the total amount an asset has been depreciated up until a single point.

Accounting for Accumulated Depreciation

This account is paired with and offsets the fixed assets line item in the balance sheet, and so reduces the reported amount of fixed assets. This account has a natural credit balance, rather what does the credit balance in the accumulated depreciation account represent than the natural debit balance of most other asset accounts. Despite these factors, the accumulated depreciation account is reported within the assets section of the balance sheet.

Straight-Line Method

As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy. Financial analysts will create a depreciation schedule when performing financial modeling to track the total depreciation over an asset’s life. The accumulated depreciation for the asset would be $4,600 for the first year and grow by another $4,600 in each subsequent year. Let’s consider a simple example to illustrate how accumulated depreciation works in accounting. This is called depreciation—the opposite of appreciation, which is an increase in value.

Accumulated depreciation is an accounting concept that represents the total amount of an asset’s cost that has been depreciated (i.e., expensed) over time. It is a contra asset account, meaning it is paired with an asset account but has the opposite balance. While assets usually have debit balances, contra asset accounts like accumulated depreciation have credit balances. The depreciation expense would be completed under the straight line depreciation method, and management would retire the asset.

Depreciation prevents a significant cost from being recorded–or expensed–in the year the asset was purchased, which, if expensed, would impact net income negatively. Accumulated depreciation is the cumulative depreciation of an asset that has been recorded. Depreciation expenses a portion of the cost of the asset in the year it was purchased and each year for the rest of the asset’s useful life. Accumulated depreciation allows investors and analysts to see how much of a fixed asset’s cost has been depreciated.

Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets. In other words, depreciation spreads out the cost of an asset over the years, allocating how much of the asset that has been used up in a year, until the asset is obsolete or no longer in use.

In other words, it’s a running total of the depreciation expense that has been recorded over the years. In simpler terms, depreciation spreads out the cost of an asset over its years of use, determining how much of the asset has been consumed in a given year, until the asset becomes obsolete or is no longer in use. Without depreciation, a company would have to bear the entire cost of an asset in the year of purchase, which could have a negative impact on profitability. For example, in the second year, current book value would be $25,000 – $5,000, or $20,000.

- Without depreciation, a company would have to bear the entire cost of an asset in the year of purchase, which could have a negative impact on profitability.

- A depreciation expense, on the other hand, is the portion of the cost of a fixed asset that was depreciated during a certain period, such as a year.

- At H&CO, our experienced team of tax professionals understands the complexities of income tax preparation and is dedicated to guiding you through the process.

- Accumulated depreciation is recorded in a contra account as a credit, reducing the value of fixed assets.

Thus, accumulated depreciation appears as a negative figure within the long-term assets section of the balance sheet, immediately below the fixed assets line item. Accumulated depreciation is recorded in a contra-asset account, meaning it has a credit balance, reducing the fixed assets gross amount. Tracking the depreciation expense of an asset is important for accounting and tax reporting purposes because it spreads the cost of the asset over the time it’s in use.